With Gary Cokins

Traditional or Financial Accounting is essential for statutory and regulatory reporting for government agencies and the investor community. It is guided by Generally Accepted Accounting Principles (GAAP). It is best referred to as “external” financial accounting. But here is the problem: Colleges know in detail how much they spend; however, the vast majority don’t know how much things cost. Let’s take a simple example, people and buildings, as these are two of the larger expenses for colleges.

External financial accounting will report exactly how much was spent on payroll, but not what those people do. Likewise, it will also report exactly how much is spent on rent and building maintenance or how much is allocated for depreciation, but it won’t tell you what the buildings are used for. Traditional accounting will report the salary expenses of faculty but does not report the costs of different curriculums, types of courses, and types of students.

Expenses and costs are not the same thing. Expenses are when an organization pays suppliers or employees. It is from a checkbook; money exits the treasury. In contrast, all costs are calculated such as the cost of process or service. With “internal” management accounting, inputs (i.e., expenses) equal the outputs (i.e., costs).

Why is this important? Because to effectively manage the institution one needs to know how all the resources are being used, this includes people, facilities and money. This allows the institution to calculate the full cost of their primary outputs – teaching, research, community support, athletics programs and any commercial activities they might undertake.

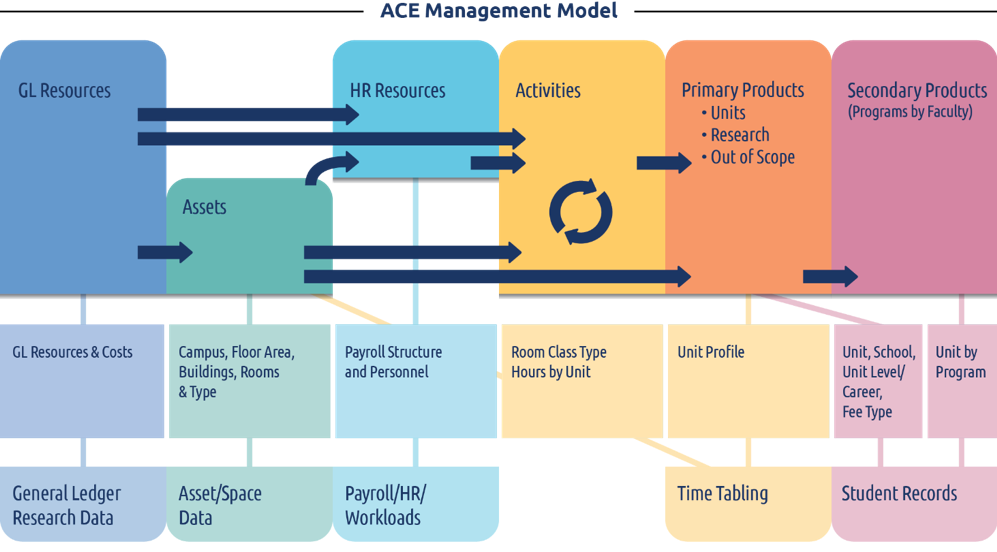

It is understandable that Deans will know what their academic staff are doing, managers will know what their support staff are doing, and facility managers know what the buildings are used for. However, the trick is to bring all that data from these disparate management systems together in a systematic and consistent way to understand the resulting costs from those work activities to gain insights and compare different types of costs in order to support strategic decision making. Many institutions do this already, by investing in Data Warehouses or Data Lakes. Unfortunately, this then requires someone to “connect the dots” to view how all these systems relate to each other. For example, what is the relationship between academic staff, rooms, utilities and tuition received from students?

This is where the modeling comes in. Models can source the data required from the existing Data Warehouse or Data Lake, and then take it that one step further and connects it all together using cause and effect relationships. And costing models, the foundation of management accounting, communicates these relationships in the language of money.

Within each College or University, teaching usually brings in most of the revenue to a college, however many institutions won’t know how much it costs to teach an individual course or even a type of student. As mentioned in a previous blog post, linking revenue from students to the full cost of courses undertaken is a major problem for institutions, but it is vital to understand this to calculate detailed profit margins and ensure the long-term financial viability of the entire institution. The term “profit” is alien to universities. But the term needs to be part of their future nomenclature, or at a minimum, the term ‘margin’. They need to granularly know their revenues and associated costs to report which courses provide surplus or deficit cash flow to the university as a whole. Although Universities are Not-For-Profit and driven more by Mission than Margins, they still need to operate in a business-like fashion. You can have the best mission in the world, but it’s useless if the institution runs out of money.

Let’s look at a typical School trying to decide whether to add new programs, cut old programs or grow existing programs. There are several factors that need to be considered and Professor Bill Massy summarizes them in his book Reengineering the University – Mission, Market and Margin. Being Mission focused is core to this decision-making process. When it comes to Market analysis there are usually a lot of data available to support this. The weakest link is Margin. Unfortunately, profit margin calculations are usually done in an ad-hoc manner and traditional accounting doesn’t help with this type of analysis. Again, external financial accounting reports details for how much is spent (or planned to be spent in the budget), but it does not report how much things cost. Costs are required to calculate these detailed profit margins – the surpluses and deficits of cash flow.

So, what does a School do? They pull out the spreadsheet and start adding up all the costs associated with teaching their individual programs. Unfortunately, this is usually focused on direct cost only. Things become more complicated if they try to allocate all the indirect and support expenses (commonly referred to as “overhead”) provided by the institution. A school typically won’t worry too much about all the indirect and overhead expenses because they believe they cannot be easily controlled. But it’s vital to know the indirect expenses from an institutional perspective, so that the overall financial position of the college is known, including down to the full cost of individual courses, programs and types of students. In addition, there is a lot of cross-subsidization inside colleges – just because one school is losing money, doesn’t make it bad. That school’s programs could be vital to the overall mission of the college. But the college needs to ensure that loss (i.e. deficit cash flow) is covered with surplus cash flow by other schools.

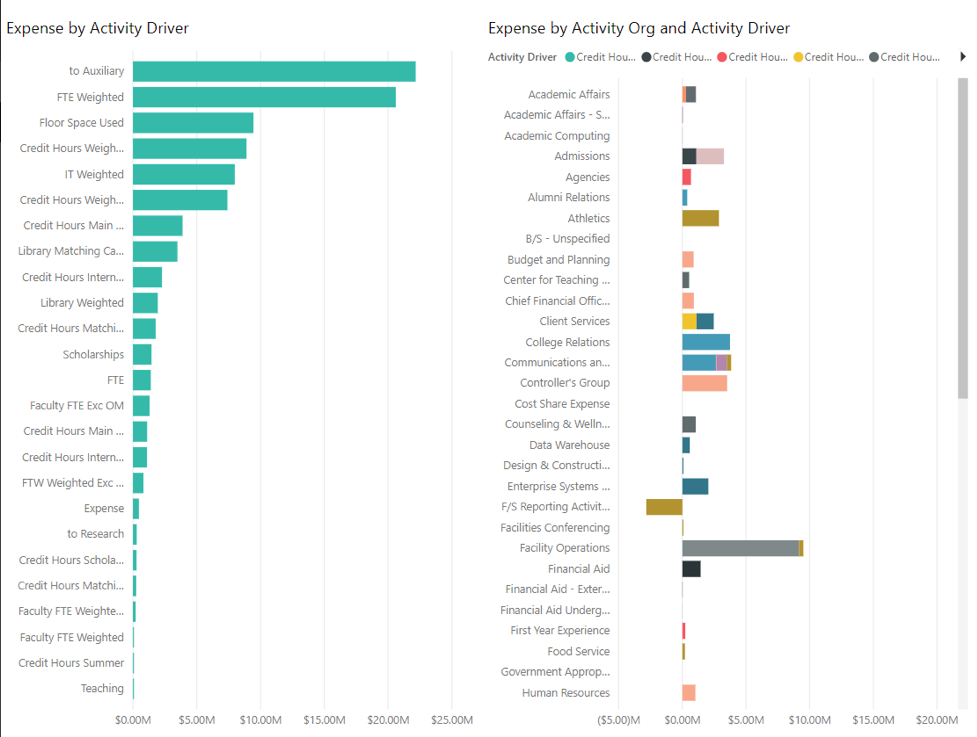

The screen shot above shows a typical range of support and overhead costs and the multiple ways they are distributed (i.e., causally traced and assigned) through the college. The combined overhead for a college could easily make up 50% or more of the total cost of an institution, so it is a substantial component of a college’s expense structure. It should not and cannot be ignored.

The problem is that to build all these cost allocations in a spreadsheet is a large, complex and manual process. And worse yet, the basis for the cost allocations typically violate management accounting’s “causality” principle using factors like number of employees rather than “cost drivers” that reflect how those work activities are consumed by the types of courses or students.

The allocation of indirect expenses (i.e., overhead) is a core capability of the model mentioned previously. They should ideally be causally and proportionately traced and assigned rather than spread like butter across bread. The objective is to use a range of modelling techniques to automate these cost assignments (i.e., allocations) as much as possible, for the initial build but more importantly for the regular updates of the model.

In summary colleges and universities should want to use a costing model to identify what their people do inside the institution, how the buildings are used, and in fact, how all the resources are consumed to support the mission and objectives of the college. This provides the detailed costs and profit margins (i.e., cash flow surpluses and deficits) required to support strategic decision making that isn’t provided by traditional external financial accounting. Colleges and universities need to appreciate the importance of operating in a business-like fashion to ensure they are financially sustainable to support the overall mission of the institution well into the future.

Gary Cokins (Cornell University BS industrial engineering/operations research) 1971; Northwestern University Kellogg MBA 1974) is an internationally recognized expert, speaker, and author in enterprise and corporate performance management (EPM/CPM) methods and systems. He is the founder of Analytics-Based Performance Management LLC www.garycokins.com. He began his career in industry with a Fortune 100 company in CFO and operations roles. Then 15 years in consulting with Deloitte, KPMG, and EDS (now part of HP). From 1997 until 2013 Gary was a Principal Consultant with SAS, a business analytics software vendor. His most recent books are Performance Management: Integrating Strategy Execution, Methodologies, Risk, and Analytics and Predictive Business Analytics.

Gary Cokins (Cornell University BS industrial engineering/operations research) 1971; Northwestern University Kellogg MBA 1974) is an internationally recognized expert, speaker, and author in enterprise and corporate performance management (EPM/CPM) methods and systems. He is the founder of Analytics-Based Performance Management LLC www.garycokins.com. He began his career in industry with a Fortune 100 company in CFO and operations roles. Then 15 years in consulting with Deloitte, KPMG, and EDS (now part of HP). From 1997 until 2013 Gary was a Principal Consultant with SAS, a business analytics software vendor. His most recent books are Performance Management: Integrating Strategy Execution, Methodologies, Risk, and Analytics and Predictive Business Analytics.

thank you for sharing. Its very informative.