The Critical Course Metric you probably don’t know about

Affordability and Financial Sustainability are primary concerns cited by Boards of Trustees of higher education institutions as stated in the latest AGB 2018 Trustee Index.

Unfortunately at most institutions there can often be a huge disconnect between affordability (price/revenue) and sustainability (cost/margins).

To determine if this is an issue at your institution, just ask this very simple question “can we easily connect the revenue received from students to the full costs of the actual courses1 they are undertaking?” In many institutions this is a fundamental problem despite it being a critical connection as it pinpoints the actual underlying economics of the institution.

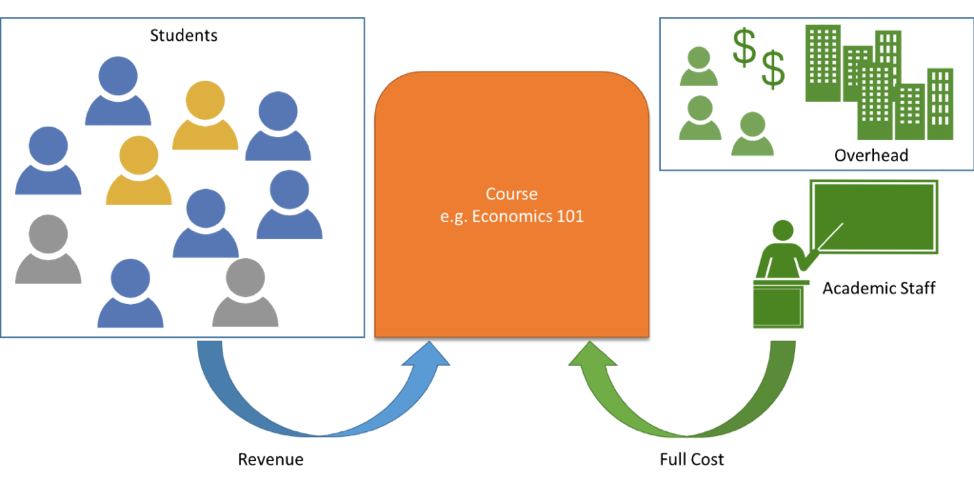

The COURSE is key! Why? Because this is where the interaction occurs between the revenue (the net tuition each and every student brings in) and full cost (academics, academic support, facilities, finance, HR, Payroll, IT etc) as shown in the diagram below. This is where the core component of work (teaching) occurs in the institution. Understanding the detailed course financials is critical – without this, the actual financial performance of the institution is clouded.

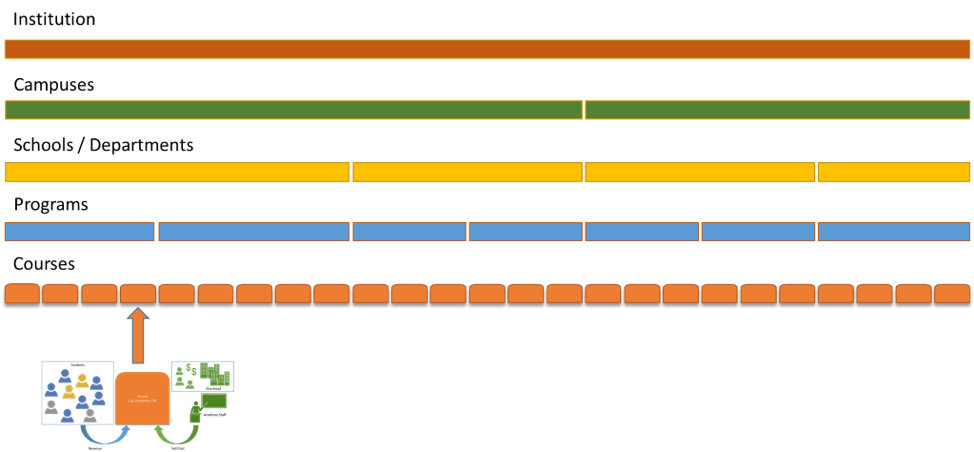

Once you have a full grasp of the granular course financials, these can be rolled up to Programs, Schools, Colleges /Faculties, Campuses, and if applicable, systems, and most importantly, reconciled to the statutory financial reports. The course financials are the economic building blocks of the entire institution.

Most institutions will have an excellent understanding of their revenue. Unfortunately, the cost side of the equation is a different story. Most institutions will have a relatively good idea of their core direct costs, however this may only be for a particular school or department, and not for the individual course or program. Overhead costs are often the least understood, in particular how much is spent to support individual courses. Many institutions would struggle to understand the key drivers in their organizations, and how costs change based on the different profiles of each course e.g.

- student numbers (i.e. how much does one more student cost in each course?)

- student type (domestic / international or in-state / out-of-state)

- delivery method (online vs face-to-face)

- standard sessions vs summer sessions

Institutions have been operating just fine for hundreds of years without knowing this, so why do they need to know it now? Because things are getting tougher for US institutions – Government funding is declining, there is more competition from non-traditional education providers, there is public push-back on tuition increases as well as even questioning the value of Higher Education. Compounding this, the overall student population is shrinking due to a drop in birth rates and a drop in international students. This isn’t just an issue for US Institutions, this is quickly becoming a global problem as well.

The core of the problem is that decisions are being made with financials that don’t reflect the true situation of the institution. When everything is fine and the institution is making a healthy positive margin then there is really no need to delve into these financial details. However, things change quite a bit when there is a sudden (and often unexpected) drop in revenue. To quote Mike Tyson “Everyone has a plan until they get punched in the mouth” – how the institution deals with this metaphorical punch is key. The situation could easily be made worse by making decisions on clouded financials. Understanding where you are making money and where you are losing money at the course level is therefore critical!

If you would like to read more about the types of analysis that can be performed with course-level financials then please refer to this previous blog post.

Normally I find your posts very helpful, but I am going to disagree with the underlying premise of this one. More detailed course data are helpful for understanding academic costs, but courses are not the key link between revenue and full cost. Significant overhead costs are driven either by non-academic factors or by long-term decisions about cost structure and resource allocation, at least in the United States. There is also a lot of arbitrariness about the allocation of overhead costs to outputs and also to unit proxies for cost drivers (students, courses, graduations, etc. in both cases); as I understand it, Pilbara’s software does a good job of allocating these costs, but it should be kept in mind that allocation rules are not objective facts but rather result from judgments and decisions. It is an interesting question what the key link is between affordability and sustainability, but I would argue that it is a combination of long-term decisions about institutional cost structure, market positioning (which drives, among other things, selectivity, sticker price elasticity, and gifts/grants), and ability to adapt to changing environmental conditions.

Hi Carl, Thanks for your comment. Yes I absolutely agree with your statements on overhead costs. Maybe I was unclear in the article, I didn’t mean to imply that courses determine these costs, rather they are a container of costs and that all of the overhead that contributes to the full cost is not transparent. When you can see where all of the costs come from then you can start questioning that cost and managing it appropriately. The link between the full cost and revenue provides the course margin, which rolls up to overall institutional margin (including all of the overhead) and any other subsidizing costs like internal research. The main point is about cost transparency and breaking it down to a core component (the course). Now what the institution can or can’t do about all of the overhead is the tricky part.