Management accounting, as a discipline, is going through a resurgence. Primarily driven by the huge increase in the amount of data available for analysis, financial professionals are needing to look beyond traditional business metrics and recognize the potential of embracing a wider set of data.

Management accounting has been around for 100 years, so it’s certainly not new. What has changed is the huge and growing data sets. According to the Institute of Management Accountants (IMA) – Management Accounting can explain the “why” behind the numbers, not just the “what”. Management accountants bring strategic thinking, applied work experience and the ability to convert data into dialogue.

This is relevant to Higher Education managers as well – not just Financial Managers but also Provosts and Deans. According to the book “How to Run a College” by Brian Mitchell and W. Joseph King, when discussing the importance of faculty in shared governance “They (faculty) are the resident experts. Their expertise shapes critical directional markers about where a college or university heads strategically. To be effective, however, faculty must move beyond wish lists to understand how programs relate to staffing and facilities within an operating budget. The most successful faculty leaders learn how budgets affect strategic direction …” They also state that Higher Education stakeholders will need to “understand the comprehensive interconnection between the people, programs and facilities that shape an institution’s direction. Survival means understanding how the pieces work together.”

The Chartered Global Management Accountant (CGMA), which is a joint venture between two accounting bodies, AICPA and CIMA, released a paper titled “Big Data – Readying business for the big data revolution.” Their research highlighted the fact that nearly 9 in 10 organizations are struggling to get valuable insight from data and that management accountants have an important role to play in ensuring business success in today’s data-driven era.

They state in their paper that “A business needs to have the right data, the ability to analyse it, a culture where the use of data is expected and the skills to ensure that insights are applied to create value.” They suggest there are four key competencies:

- Data Analytics

- Data Management

- Data Culture

- Value Creation

Under Data Analytics they state that the “scale and complexity of the data sets now available often require a data scientist’s advanced levels of analytical skills for data mining, deriving algorithms and predictive analytics…In the future, however, advanced data skills may not always be necessary to conduct complex analysis. New software, such as data visualization tools, may enable business users to analyse data on a self-service basis.” – that future is actually now.

Big Data is a reality for many organizations around the world, but there are a substantial number of institutions that are not yet making the most of their current data.

In Professor William F. Massy’s upcoming book “Resource Management for Colleges and Universities” he states “American colleges and universities remain the gold standard for world-wide higher education, but flaws in their decision-making cultures and business models are becoming ever more apparent.” Professor Massy goes on to describe “Academic Resourcing (AR)” as a way of using broad data sets to support better Higher Education decision-making. “AR deals with resource allocation writ large: not just the university’s budget and associated processes, but to everything that involves the application of money, human resources, and physical resources like facilities and equipment to the furtherance of academic goals. This applies both to so-called ‘direct activities’ like teaching, research, and service, and to indirect ones like academic and institutional support. In other words, the ideas expressed in this book have the potential to impact everything and everyone.”

The Model

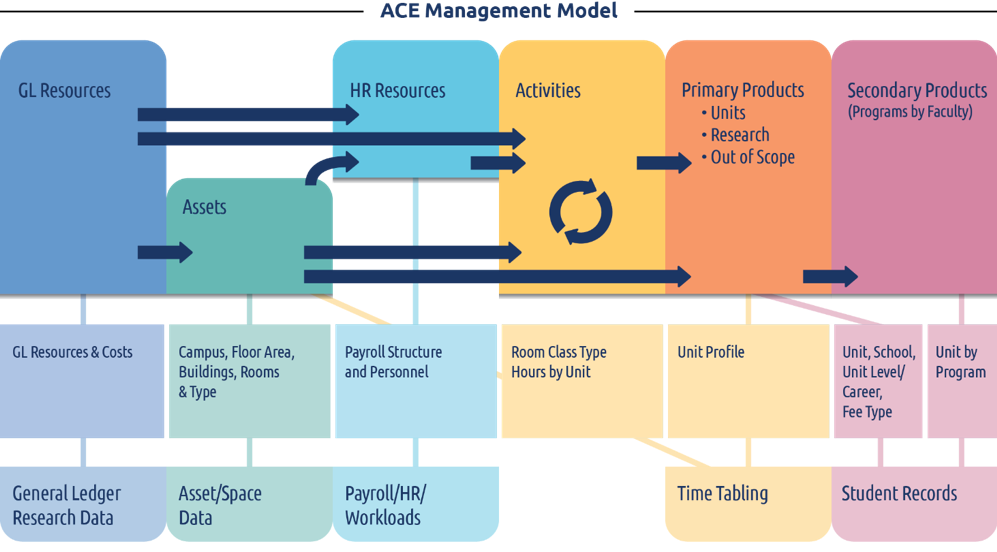

Professor Massy and Brian Mitchell/W. Joseph King recommend bringing a range of data together (not just financial data) to support strategic decision making. Bringing all of these disparate data sets together into one big database and then using a “data visualization” tool for analysis is a logical first step. The problem with this is that there is no “comprehensive interconnection” created between all of these data sets, as recommended by Brian Mitchell/W. Joseph King. What is needed is a way of connecting all of this data together, in a systemized way, based on cause and effect relationships that represents the way the institution actually operates. It’s a model of the entire institution that can be interrogated in a wide-range of different ways by both administrators and faculty using one common consolidated data set.

A schematic for the model is shown below – as discussed previously this brings together money, people, physical resources, programs, courses and includes all of the complex interconnections in one big model for the entire institution.

This type of model has been successfully implemented across multiple institutions in the US, Canada and Australia. In 2019 NACUBO conducted a survey of business officers to determine their most pressing requirements in the operation of their respective institutions. The key outcomes and needs of business officers identified from this survey were:

- Operational analysis/operation efficiency

- Cost of Instruction

- Internal Academic Program Assessment

- Faculty Workload Analysis and Planning

- Human Resources (as in what they are working on), including non-academic personnel

- Space Utilization

- Enrolment (as in the numbers and types of students enrolled in different courses/programs)

- Supporting aspects of the development of the strategic plan

- Profit/Loss (Financial Performance)

- Research Costings

The model described above can address all of these requirements and can be expanded to include a wide range of other data as well including things like teaching/learning metrics, jobs data, skills demand etc.

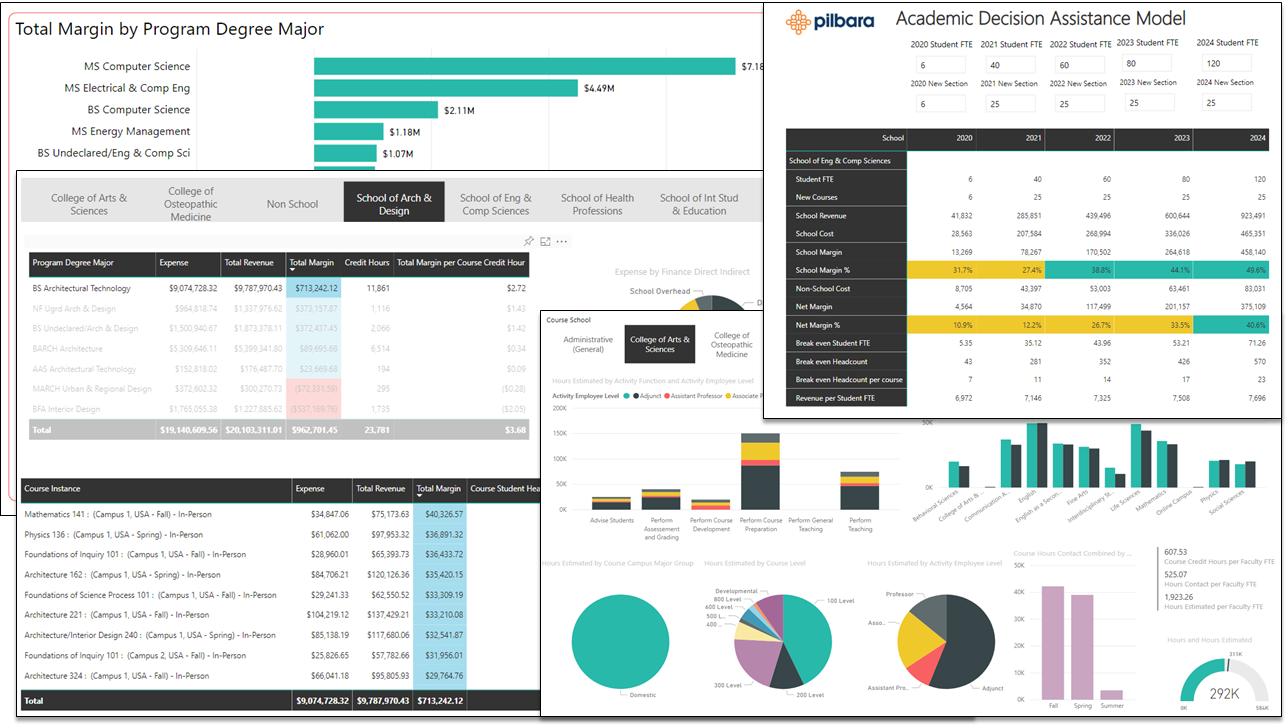

A recent survey conducted by Pilbara of institutions with these types of models in place found that the biggest use of the model was Program Evaluation/Optimization and that the two primary user groups in the institution are Finance and School/College Deans.

So this is a solution that both Finance and Faculty can use to support detailed operational decision making within their respective areas but also support big picture strategic planning and decision making, using the principles of management accounting.

If this is something you would like to try at your institution but not sure how to start, then we have developed this document which can be downloaded from here: http://www.pilbara.co/fullcostreadiness/ to provide initiation guidance and what to be aware of when building these types of models.