Identify the most economical path to carbon emissions reductions!

In order to combat climate change countries and companies around the world are all working on plans to reduce their emissions. For the last decade, a number of companies have been voluntarily reporting their emissions, unfortunately the reporting hasn’t led to any significant reduction in emissions. As Auden Schendler, the senior vice-president of sustainability for Aspen Skiiing Company, states “Measurement and reporting have become ends to themselves, instead of a means to improve environmental or social outcomes. It’s as if a person committed to a diet and fanatically started counting calories, but continued to eat the same number of Twinkies and cheeseburgers.”

reporting their emissions, unfortunately the reporting hasn’t led to any significant reduction in emissions. As Auden Schendler, the senior vice-president of sustainability for Aspen Skiiing Company, states “Measurement and reporting have become ends to themselves, instead of a means to improve environmental or social outcomes. It’s as if a person committed to a diet and fanatically started counting calories, but continued to eat the same number of Twinkies and cheeseburgers.”

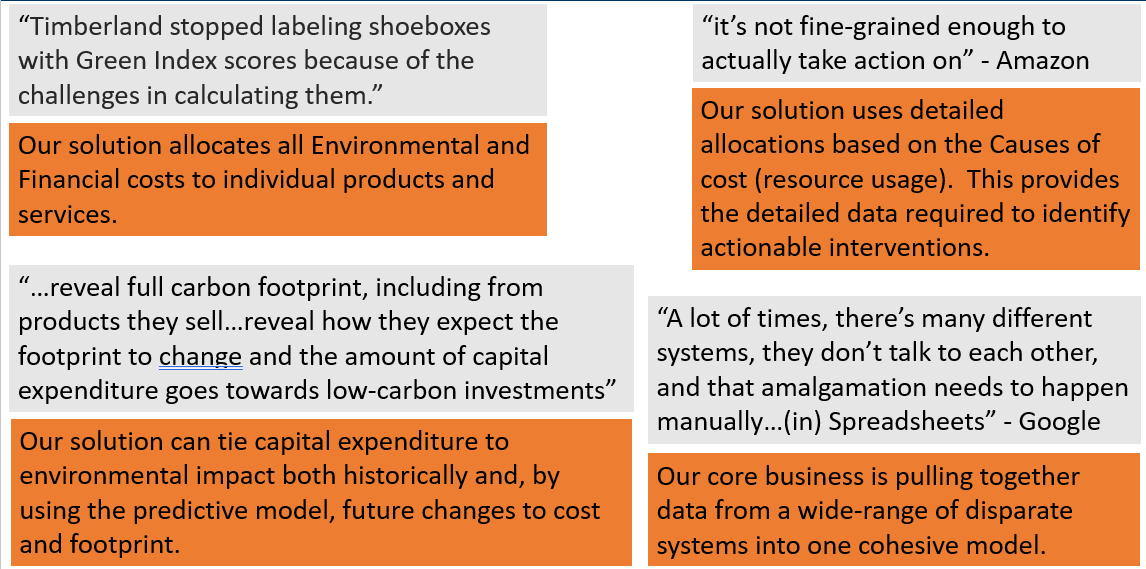

Kenneth Pucker, COO of Timberland stated “The limitations of sustainability reporting became apparent at Timberland too. Despite the leadership team’s good intentions, as revenues grew during my tenure, so did the company’s environmental footprint. And sometime after my departure, and after the company was sold to VF in 2011, Timberland stopped labeling shoeboxes with Green Index scores because of the challenges in calculating them.”

Kenneth Pucker, COO of Timberland stated “The limitations of sustainability reporting became apparent at Timberland too. Despite the leadership team’s good intentions, as revenues grew during my tenure, so did the company’s environmental footprint. And sometime after my departure, and after the company was sold to VF in 2011, Timberland stopped labeling shoeboxes with Green Index scores because of the challenges in calculating them.”

According to an article by Betsy Verecky for the MIT Sloan School of Management “Companies need trusted data to track their sustainability efforts and show stakeholders they’re making progress.”

The trick is to have trusted data that leads to actions that reduces a company’s emissions.

Associate Professor at UC Berkeley, Dara O’Rouke while working for Amazon said “Amazon measures its carbon footprint and while that’s important, it’s not fine-grained enough to actually take action on … and not useful for a business leader to figure out what can they do in their business to decarbonize… Amazon built detailed models for its businesses to show factors such as the grams of carbon dioxide released per unit shift and the electricity required to power data centers. ”

And Google are having issues as well, according to Laura Franceschini Sustainability Strategy and Operations at Google “One big problem many companies face: Sustainability data is usually located in different places in different systems and requires many parties working together to get the right metrics… A lot of times, there’s many different systems, they don’t talk to each other, and that amalgamation needs to happen manually,”

The International Federation of Accountants’ (IFAC) international guidance document, “Environmental Management Accounting,” discusses current challenges in environmental management accounting. The article points out that environment related costs are often “hidden” in overhead accounts. The guidance states:

“Organizations have taken different approaches to resolving the issue of hidden environment-related costs. One common solution is to set up separate cost categories or cost centres for the more obvious and discrete environmental management activities. The less obvious costs that will still appear in other accounts and cost centres can be more clearly labeled as environment related so that they can be traced more easily. An assessment of the relative importance of environment-related costs and cost drivers of different process and product lines, in line with the general practice of activity-based costing (ABC) can help an organization determine whether or not the cost allocation bases being used are appropriate for those costs.”

The “Environmental Management Accounting Procedures and Principles” paper from the United Nations Division for Sustainable Development advocates a similar method:

“Whenever possible, environment-driven costs should be allocated directly to the activity that causes the costs and to the respective cost centres and cost drivers. Consequently, the costs of treating, for example, the toxic waste arising from a product should directly and exclusively be allocated to that product. Many terms are used to describe this correct allocation procedure, such as environmentally enlightened cost accounting, full cost accounting or ABC/M. ABC/M, is a product costing system…that allocates costs typically allocated to overhead in proportion to the activities associated with a product or product family’”

Simply put, ABC/M can help move GHG costs from the catch-all line item of “overhead” and directly assign them to particular activities and cost objects which can then be analyzed for performance.

What’s needed is a centralized, standardized and systemized way of collecting trusted data and then building these ABC/M models by linking this data to the actual operations of the organization through to the final products or services provided.

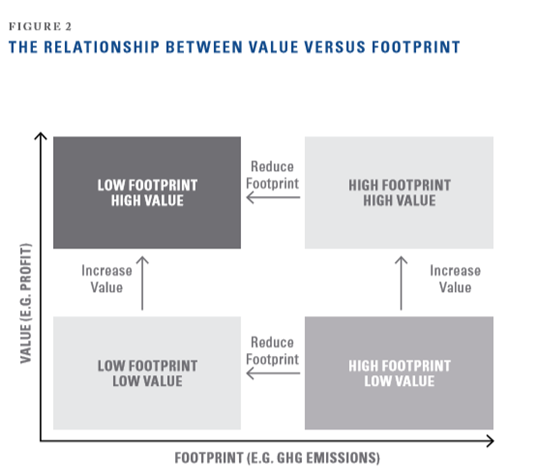

An even better solution would be to include all the financial data as well, so that executive management can develop strategic plans with full knowledge of both financial and environmental impact.

This model would be based on the Activity-Based Costing methodology and include BOTH Financial data and Environmental Data.

And the good news is that it exists already!

Carbon and Cost Budgeting!

Traditional budgets are focused on spend management – How much do we plan to spend on salaries? How much do we plan to spend on facilities? What traditional budgeting doesn’t provide is what those people and buildings are used for. Cost is different to spend. Cost is a function of resource consumption. Resources include people, facilities, equipment, cash. Cost is also more than just a financial cost, each resource can have an Environmental Cost (or Social Cost) associated with it. By focusing on Cost Management and Cost Budgeting rather than traditional budgeting you get a wide-range of extra dimensions of analysis for management purposes.

You can see both the financial and environmental costs of all the jobs (activities) undertaken in your organization as well as the full financial and environmental costs of all of the individual products or services produced and the full costs of customers or sales channels.

Providing the insight you need to properly MEASURE and MANAGE both FINANCIAL and ENVIRONMENTAL costs to enable executive management to develop strategic and actionable plans to find the most economical path to reducing emissions.

So, what is our solution?

We build models that can be used to identify actionable steps but also test those actions in advance to see if it will have both a positive financial and environmental impact.

Using the analogy from above, current carbon accounting software and consulting firms provide the “calorie counting”, which is still an important step, but we take it one step further and develop the diet plan by knowing in minute detail how your body consumes those calories.

As mentioned previously, it all starts with resources, which include people, buildings, equipment, money – each resource will have a financial component and an environmental component. For carbon accounting this includes direct emissions (Scope 1), Indirect emissions via energy usage (Scope 2) and Embodied emissions via resources and activities which includes purchased materials, business travel, fuel usage, outsourced activities (Scope 3). We want to trace each of these individual resources, through the operations (activities) of an organization right through to the final product or service provided by the organization.

This is vitally important for forecasting, as required by the Task Force on Climate-Related Disclosures (TCFD) and now the newly proposed SEC rule– you must understand the cause and effect relationships, at a very detailed level, between the inputs of the organization (resources) and the outputs of the organization (products/services).

When this is defined then you can develop strategic forecasts based on changes to these outputs and the resultant change to inputs which will have a direct impact on the financial and environmental costs.

This means you will also be able to forecast and quantify the financial risk of climate change – because we have a full operating model of the organization we can determine the impact of climate-related policies, emerging technologies, transition plans to greener products etc.

So how could this model be used?

It can be used to analyze detailed historical performance or run one or many different forecasting scenarios for executive management to review and determine appropriate strategies. A major advantage of this type of model is that it’s an enduring model, that is, it is updated and adjusted over time as things change so that the organization can regularly check actuals to forecast and course correct along the way to ensure they still reach their preferred destination. This can also be done 1,5 or 10 years in advance to ensure longer term plans can be properly developed and reported on.

Let’s take a look at some examples:

ENERGY – An energy company wants to transition away from oil/gas and increase renewable sources of energy. As oil/gas products are reduced and as renewables are ramped up, what are the resourcing impacts and therefore the financial and environmental impacts of this transition? What are the revenue and therefore profitability impacts of this transition? Over what time-period will this occur? What is the appropriate transition rate considering the longer-term financial risk compared to the environmental impact?

HIGHER EDUCATION – A university wants to reduce their environmental impact, so looks for greener suppliers for a wide-range of products and services including electricity, gas, equipment etc. However, this change results in an increase in expenditure because there is a Green Premium associated with these supplies/resources. The university decides to find out where all of these resources are being used in the university – which Schools/Departments/Programs/Courses are consuming the most resources and therefore contribute the most to this increase in expense. It should be noted that this also includes all overhead as well. When they know the full extent of resource usage and therefore cost, at a very detailed level, they can start to look at actionable steps they can take to reduce resource usage and therefore reduce financial cost and environmental impact. Are there programs with low student numbers that can be removed? Are there high margin/low carbon emissions Programs that can be grown to offset this increase in expense? What is the environmental impact of growing these Programs? What is the financial and environmental impact of these changes five years and ten years into the future? Can we charge more for greener programs?

MANUFACTURING – A manufacturer of computer hardware is able to calculate the FULL carbon emissions for individual products/SKUs – this is vital information to provide to customers (for their carbon Emission Scope 3 calculations) and eventually data for them to receive from suppliers. At the moment carbon accounting solutions will calculate the carbon Emissions for the entire organization and not down to individual products using proper cause and effect drivers.

CEMENT – A cement company wants to implement carbon capture and storage technology – what is the FULL cost of this program and how much of this cost flows through to the final products? This increase in cost for the product could warrant an increase in price because of its reduced environmental impact, a green premium. It’s not greenwashing because this increase in price is supported with a robust backend model. The model could also be used to support any potential Government mechanisms like capex grants or operating subsidy to cover revenue gaps due to operating carbon capture technology as well as wider investment due diligence.

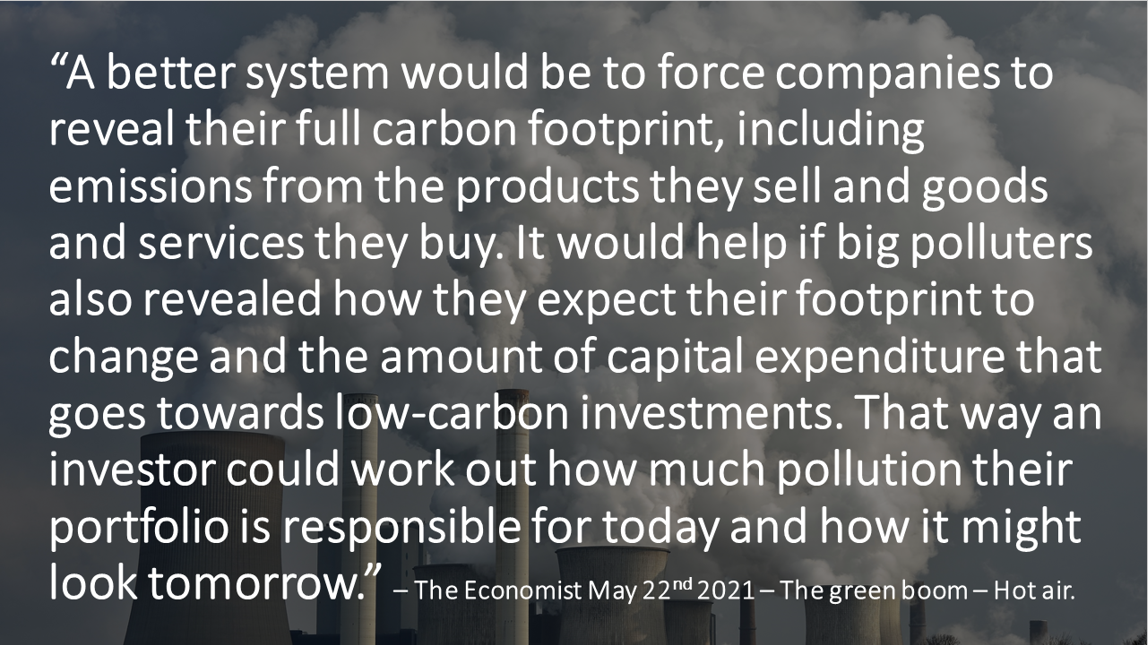

The Task Force on Climate-Related Financial Disclosures states that “Climate Change presents financial risk to the global economy” and recommend that publicly traded companies identify and report their financial risk due to climate change. The SEC is also proposing Rules to Enhance and Standardize Climate-Related Disclosures for Investors . Most Carbon accounting solutions simply focus on carbon metrics and traditional financial accounting solutions are not designed to include environmental metrics. Therefore our model can be used to tie together both carbon and financial data using “cause and effect” drivers to calculate the full environmental and financial costs of the entire organization down to individual products and services. It can also be used to forecast the future financial and environmental impact backed up by a robust and transparent modelling methodology.

Our solution can also address the problems identified by Timberland, Amazon, and Google above.

What is our experience?

We have over 20 years’ experience building large-scale models for Military organizations, Oil/Gas companies, Insurance Companies and Higher Education institutions in Australia, United States, UK and Canada.

These include standard Activity-Based Cost models as well as Predictive Models and Long-Range Decommissioning models for offshore oil/gas facilities.

Further Reading

https://pilbara.co/ABC-Sustainability

University Environmental Model Case Study