We were proud to sponsor and support the LH Martin Service Improvement and Innovation Conference down in Melbourne Oct 25 – 26. We were also pleased to assist Ray Fleming from Microsoft with his workshop, where we dug into ways data can support decision making, which we will go through later in this post.

The conference covered several key themes:

- Focusing on the Student User Experience

- Introducing new Business Models

- The Future Ecosystem of Education

- Learning to Innovate: Building organisational and personal skills in Innovation

Ray gave the key note presentation looking at change and data driven decision making. However he also demonstrated some very nice functionality built into Powerpoint (I had no idea this existed). While Ray was presenting, Powerpoint automatically created subtitles, but he also provided us all with the Microsoft translation app, we were able to follow along in real time as it translated the subtitles into a wide range of available languages, as shown below in this screen shot. This could be very powerful at international conferences but also with a class of international students!

We also heard from Professor Belinda Tynan DVC Education at RMIT. She was explaining that Lifelong learning must become the norm and what RMIT is doing to address this new trend including introducing micro-credentials that can be shared via LinkedIn, Twitter and of course blockchain. These micro-credentials can be 1-2 hours each or up to 20 hours and can be online, face-to-face or blended.

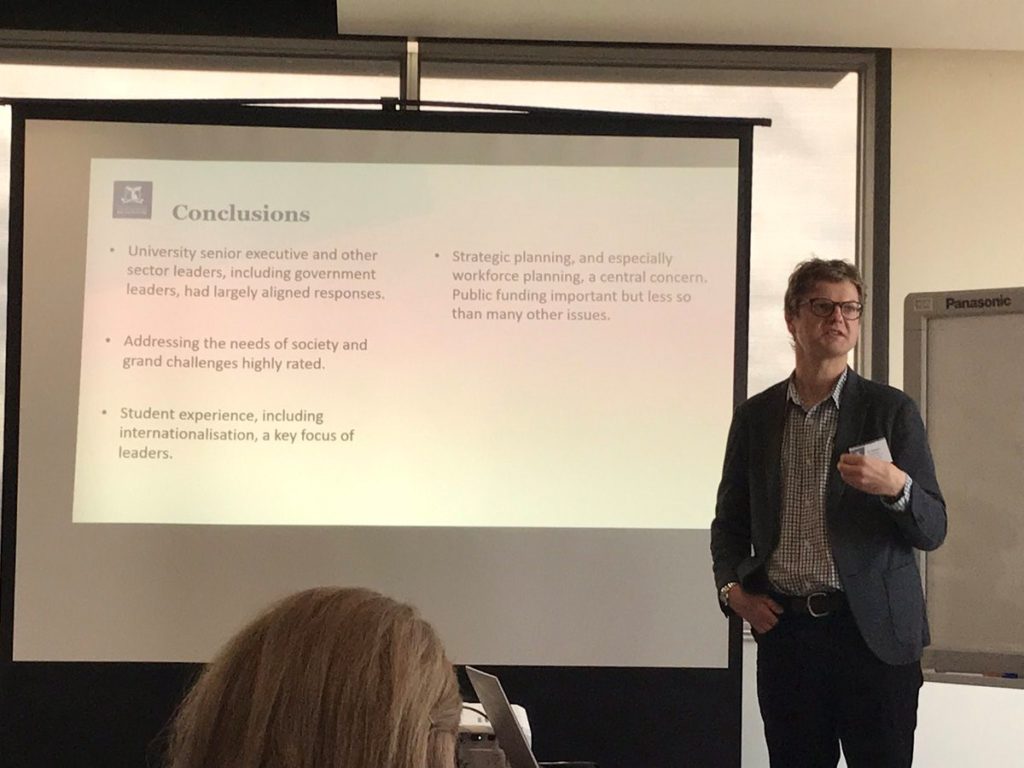

Dr Gwilym Croucher from the University of Melbourne presented the results of a survey they conducted of 114 senior HigherEd executives and Senior Government leaders on what they considered to be the top threats and opportunities in the next 10-20 years.

No major surprises from the findings – Addressing the needs of society was highly rated, as well as Student experience. It was interesting that Workforce planning was a key concern, as part of overall strategic planning.

Finally Simon Hayward, CEO of Cirrus discussed the concept of organisational agility, and to quote from his book blurb “When presented with key moments of choice, agility allows (managers) to move quickly and responsively, and offer coping strategies for this unprecedented rate of change.”

Things are moving fast in the world in general but also in the Higher Education space, after all, the Higher Education market globally is huge, around $2 trillion and growing at an annual compound growth rate of 8%. This is a big opportunity for the private sector, so traditional Higher Ed providers will need to make sure they adapt to this rapidly changing and growing market. So being an agile university, making decisions based on data, ensuring you are providing credentials that are required by the new Life Long Learner and ensuring you are addressing the needs of society are all keys to future survival.

Microsoft Worked Example

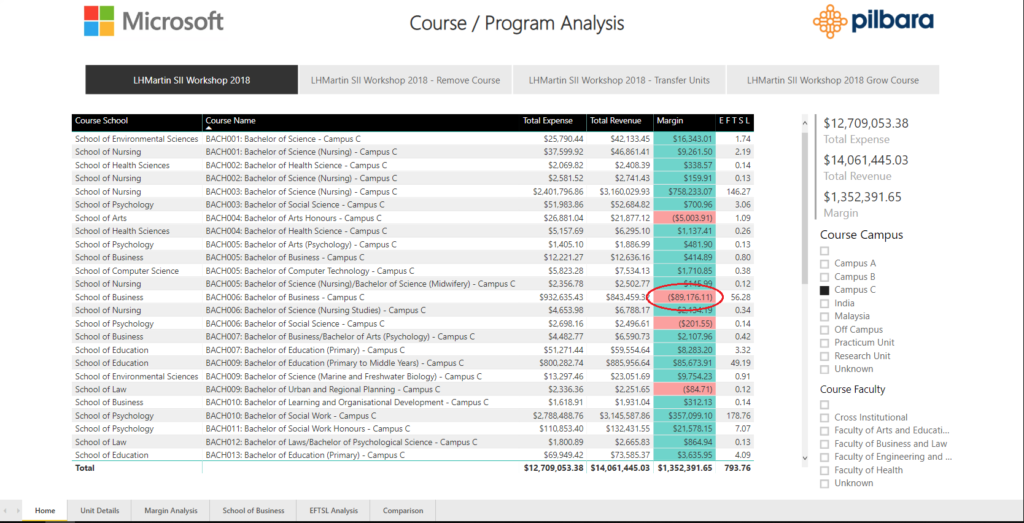

This is the worked example we went through with Microsoft at the conference. We start with a model of a mid-sized university with around $400M revenue. Now this isn’t real data we are looking at, rather it is an amalgam of anonymized and randomized data but it is representative of how a real university model operates.

The model we are using is the Predictive Model, which is used to forecast the financial impact of things like changes to student numbers and mix of different types of students, adding/removing programs/units, changes in Government funding, changes in Enterprise Bargaining Agreements etc. There are a wide range of variables available to us in the Predictive Model. It’s also an excellent tool for supporting the budget process. Rather than using last year’s budget as the baseline, we can use the predictive model to forecast the financials based on expected demand and changes to the university. This then forms the baseline to start the budget negotiations, backed up by detailed data.

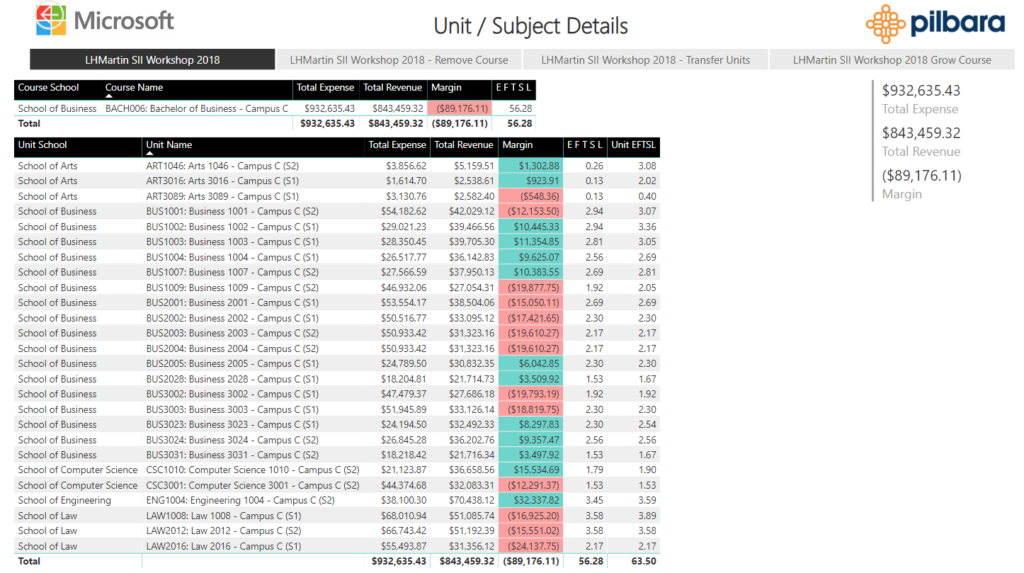

So we started with the summary report on all Programs and their associated margins. As can be seen the Bachelor of Business at Campus C is making a significant loss. So we decided to take a look at what would happen if we removed that Program – how much can we save?

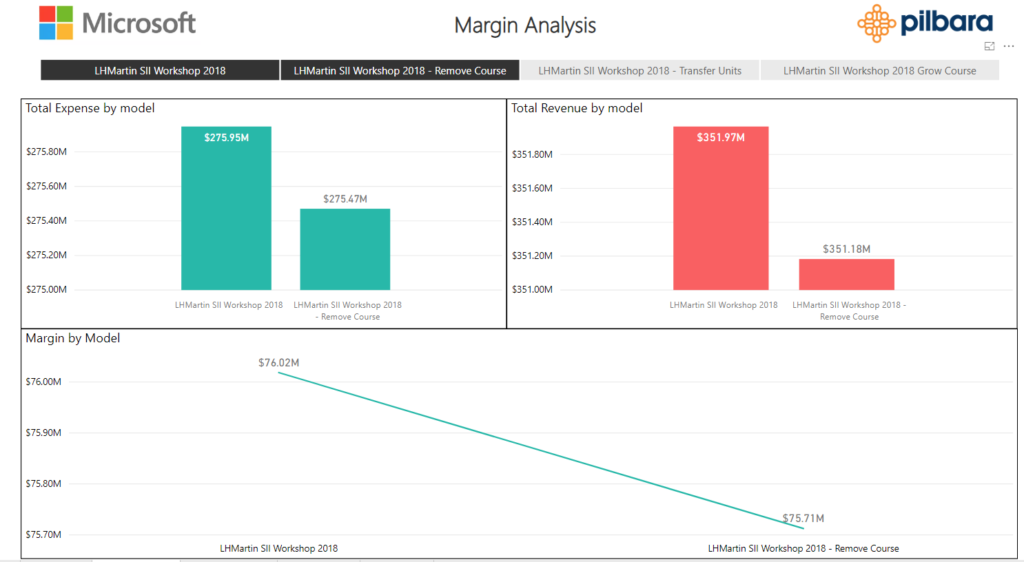

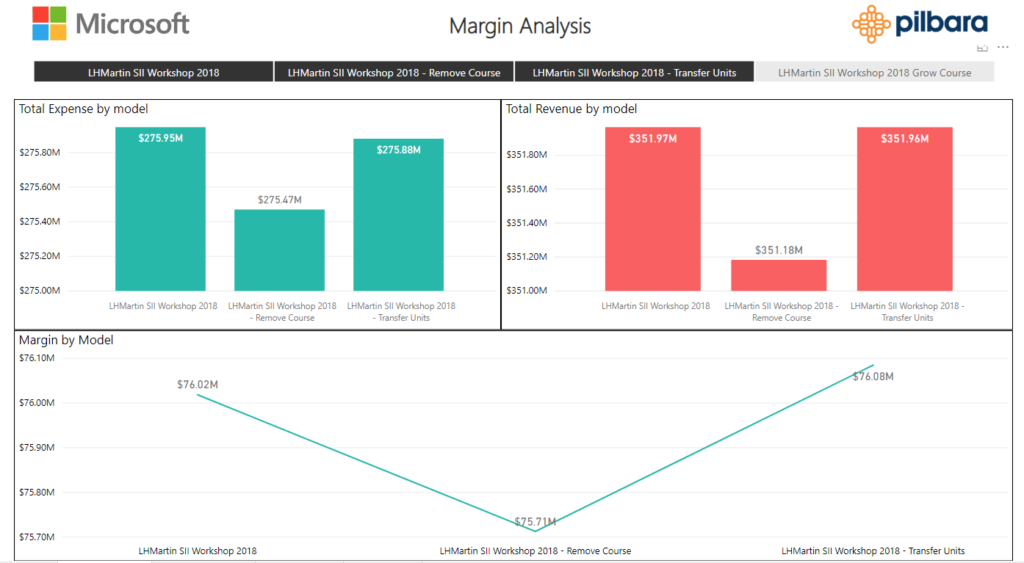

Unfortunately the overall financial position of the university actually got worse. To understand why, we can take a look at the report below. We can see that we lost more revenue than expenses, this is also BEST case scenario. This actually assumes that the staff that are no longer required to teach and support that program will be gone, when in reality this may take a few years or they may be reassigned.

If we take a look at the details of the Program another key issue is highlighted. This program crosses across a number of different schools, so making the decision to remove the program doesn’t only impact the School of Business, but also Arts, Computer Science, Engineering and Law who could all potentially lose those students.

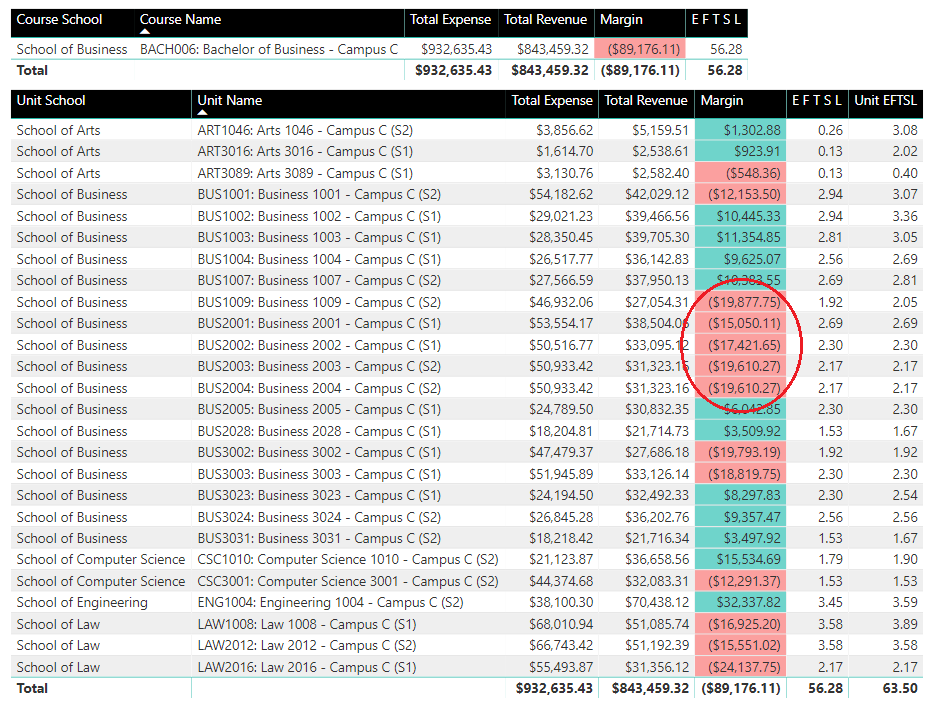

So removing the Program is not a good idea. What other options do we have available to us. Taking another look at the Unit details we can see that there are a number of big loss making units as circled below:

One option that was explored was whether these units could be taught from another Campus, but the students can access this via live or recorded webinars. The students remain, the majority of the teaching load is transferred but the local students will still need local teaching support. What impact would that have on the overall financials?

As we can see it actually improves the overall margin. The revenue remains the same but the expenses drop a little.

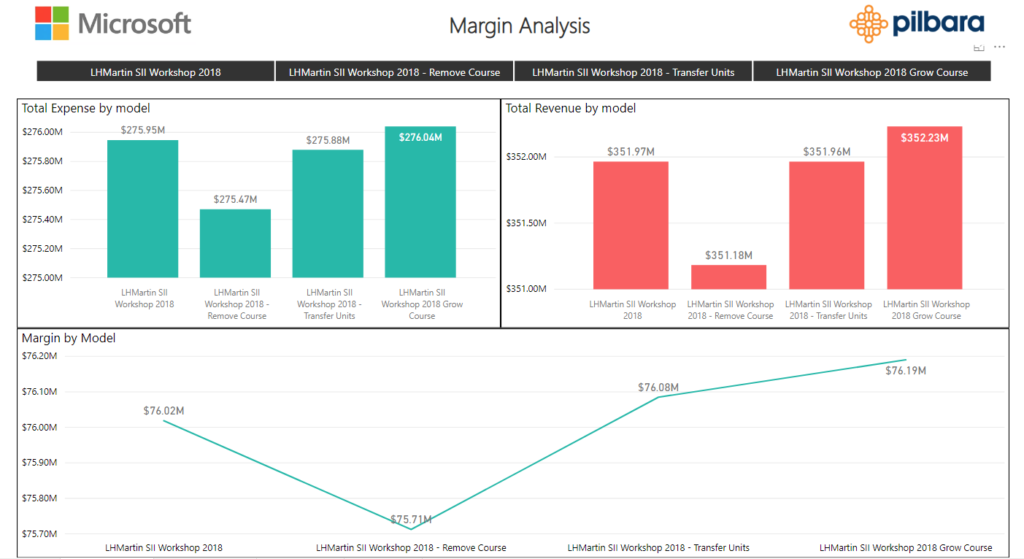

One other option that was explored was whether we can grow the Program into positive margin territory and how many students would that actually take? Noting that, although more students means more revenue, it also means more expenses. So at what point (if ever) do we break-even and start making positive margin? As it turns out, it was only an additional eleven students.

We can see that overall the margin improves with a greater increase in Revenue than Expenses.

The objective of the workshop was to demonstrate that using data, rather than gut feel, to make decisions is very important. When institutions have financial difficulties, the first course of action is to usually look for things to remove, cut costs. In reality there are probably a number of areas that could easily be reduced / removed from overhead and support areas. But once these obvious cuts are made, where do you go next? The answer is into the data, go deeper, look for all of the relationships inside the institutions. Decisions made in one area could have unintended consequences in other areas. So it’s important to understand the full economics of your institution before making big decisions and being able to test these decisions in the predictive model prior to execution is very powerful!